Asia Sourcing

China and Emerging Low Cost Countries

Asia Procurement strategies have long been centered on China and India, which are still today the main areas where to look for opportunities, but with the rising costs of manufacturing, companies have now to consider alternate Low Cost Countries.

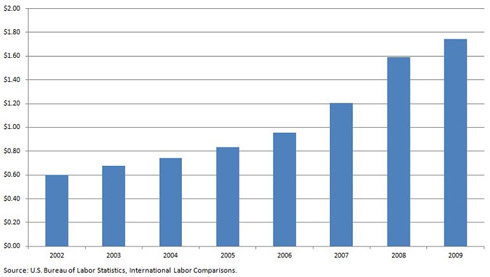

Cost increase in China is a reality

China operational costs on the East costs are on the rise for several years, with an increase of 10-15% each year. The estimations are still on the rise for the near future.

Average hourly compensation costs of manufacturing in China in USD

Besides labor costs increase China is facing further challenges:

Besides labor costs increase China is facing further challenges:

- Exchange rate & inflation

- Rising operational cost

- Labor aging and availability

- Strong internal demand growth absorbs capacity and attention of local suppliers

New manufacturing zones are emerging

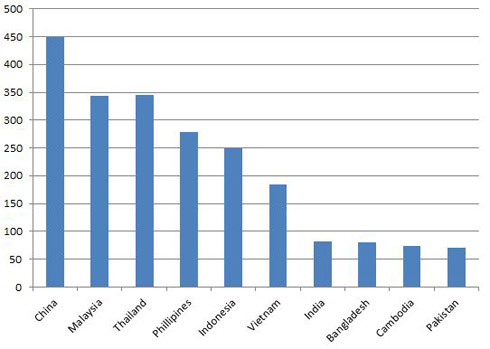

Indonesia, Vietnam, Bangladesh, Thailand, The Philippines and Cambodia are these main regional emerging manufacturing zones where to find competitive advantages for specific categories.

Average gross wages in Asia USD / Month (2013)

Source: Japan External Trade Organization 2012 But China still stays ahead and will remain the premier sourcing destination for the majority of products for at least the next decade for the following reasons: China productivity is increasing, which help ease the burden of increasing costs: in 2000 productivity rate per worker was 13% of a worker in the U.S. and in 2010 that number was 29%. Estimation by 2015 forecast China productivity will be up to 38% of a U.S. worker.

Source: Japan External Trade Organization 2012 But China still stays ahead and will remain the premier sourcing destination for the majority of products for at least the next decade for the following reasons: China productivity is increasing, which help ease the burden of increasing costs: in 2000 productivity rate per worker was 13% of a worker in the U.S. and in 2010 that number was 29%. Estimation by 2015 forecast China productivity will be up to 38% of a U.S. worker.

- Production is gradually moving inland, before leaving China. The wages in the interior of China, where cost of living and general worker education level are lower, increase at a significantly slower pace. China has indeed two very different entities, urban coast vs. undeveloped interior.

- China has moved up the value chain in past years, the production is less and less labor dependent. This explains as well the increase in labor costs: In the recent past, a high majority of sourcing in China was for industries which required unskilled workers. However, today manufacturing operations in China are increasingly demanding skilled workers, who demand a higher wage rate.

- Thanks to the wide range of categories available, China is still a compulsory sourcing area for products with a complex BOM (Bill of material). For example an electronic oven require metal parts, engine, plastic parts, printing, stickers, etc…it would be very complex to deliver these products to Vietnam for assembly

- China has the best infrastructure which limits the risks in supply chain. The country is still investing massively in the interior to decrease logistics costs, as shown the example of the China-Germany railway which will decrease the lead-time China-Europe to 13 days.